Urge your senators to vote no on the GOP tax bill

House passes tax bill funded on backs of families and students

The tax plan passed by the U.S. House of Representatives today and backed by President Donald Trump is a massive tax giveaway to the wealthiest individuals and corporations funded on the backs of students and working families.

The bill passed by a vote of 227 to 205, with 13 Republicans opposed and no Democrats in favor.

Trump is pushing hard for the plan. The U.S. Senate is currently considering its own tax proposal.

The Senate tax bill is also terrible. Among other measures, it includes a repeal of the mandate that individuals obtain health insurance — a move that would destroy the market for individuals and cause premiums to skyrocket. Either measure would be a lump of coal, not a gift, for MTA members, our students and our communities.

The House-passed bill does the following:

1. The budget cuts needed to pay for the $1.5 trillion — or more — in lost revenues over the next decade would hit schools, communities and families hard.

Tax cuts = huge deficits = budget cuts.

What would adding $1.5 trillion to the federal deficit mean to educators? Significant budget cuts for education and other services that they, their students and their communities depend on. Trump is already seeking to cut spending on education, health care, environmental protection, housing and other programs that benefit families and communities. Those cuts will be much deeper if a massive tax cut is approved.

2. It eliminates the $250 educators' tax deduction for out-of-pocket expenses for instructional materials and classroom supplies.

This tax deduction was adopted in recognition of the fact that educators spend a lot of their own money on classroom materials. Eliminating it while increasing tax breaks for corporations and the wealthy is a slap in the face.

3. Most of the benefit would go to the very rich.

Three-quarters of the benefit of this bill goes to corporations, according to the Joint Committee on Taxation. The bill would permanently cut the corporate tax rate from 35 percent to 20 percent, the biggest one-time drop in the big-business tax rate ever. Certain other businesses would also gain, particularly those that have income that “passes through” to the individual.

The remaining one-quarter of the benefit would go to individuals, though many of the tax breaks that benefit the middle class would be phased out after eight to 10 years. Individuals whose income is in the top 1 percent are by far the largest beneficiaries, receiving 50 percent of the benefits a decade from now. According to the Brookings Institution, “A big tax cut for the rich is unjustified on fairness or efficiency grounds. The highest earning households — the top 1 percent — have seen dramatic growth in income and wealth relative to other groups over the last 40 years. At the same time, their average tax rate has fallen and this bill would cause it to fall further."

And this from an analysis by The New York Times: “The bill delivers large breaks to high-earning owners of certain businesses, known as pass-through entities, which comprise most of Mr. Trump’s business empire, and to heirs of large estates, such as Mr. Trump’s children.”

4. Little benefit would go to low- and middle-income households, and some would pay more.

Most MTA members would see only a small reduction in federal taxes, if any. Again, from Brookings, “[S]ome [low- and middle-income households] will see tax increases, some will have their tax situation unchanged, and some will see tax cuts.”

What’s more, tax reductions for MTA members could easily be offset by reductions in compensation and job losses that would occur when the piper has to be paid — that is, when the government slashes funding for public education and other services to pay for tax cuts that primarily benefit the rich.

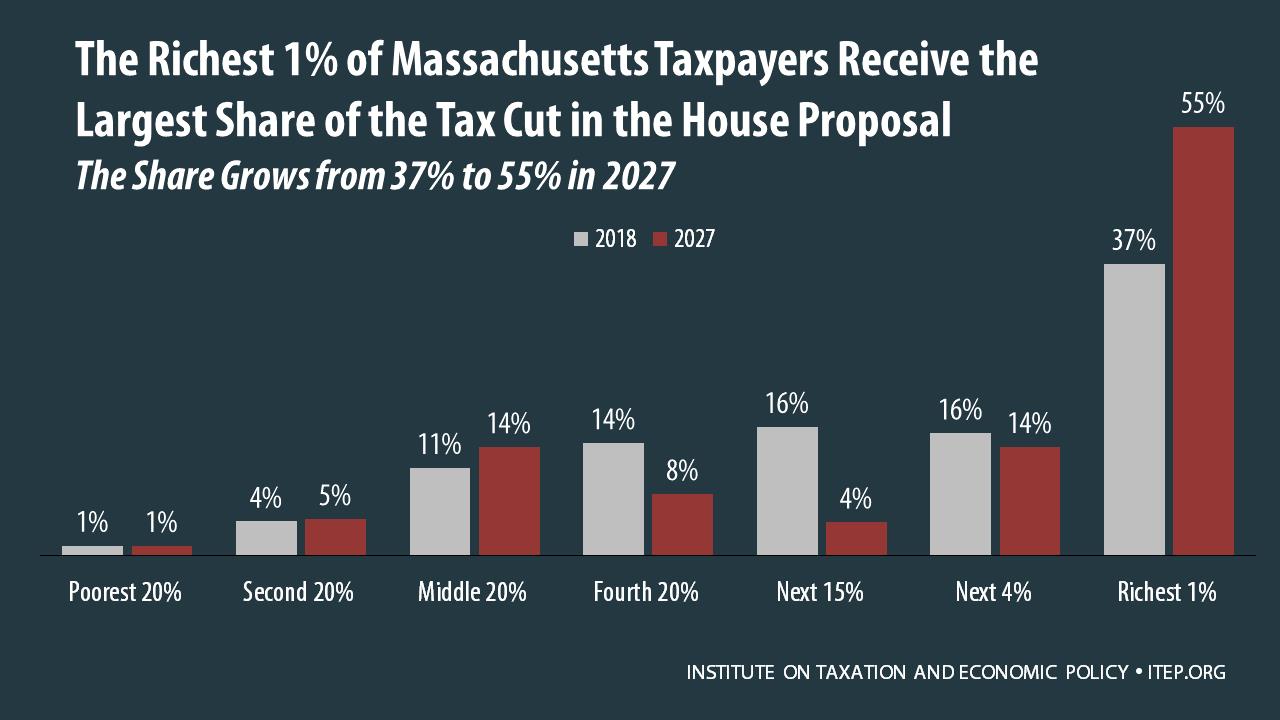

In a state-by-state analysis of the bill, the Institute on Taxation and Economic Policy found that the richest 1 percent of Massachusetts residents would not only do much better right away, but their benefits would increase over time — at the expense of everyone else. The ITEP report states: "Some of the provisions that benefit the middle class — like lower tax rates, an increased standard deduction, and a $300 tax credit for each adult in a household — are designed to expire or become less generous over time. Some of the provisions that benefit the wealthy, such as the reduction and eventual repeal of the estate tax, become more generous over time. The result is that by 2027, the benefits of the House bill become increasingly generous for the richest one percent compared to other income groups.”

5. It would make it more difficult for our state and local governments to pay for services by eliminating deductions for state and local income and sales taxes and by capping the deduction for property taxes at $10,000.

Massachusetts residents and those in other states that rely heavily on state income taxes would be hurt by a provision that eliminates the deductibility of state income taxes on federal tax returns. In addition, Brookings notes that eliminating this deduction “would make it more politically difficult for cash-strapped states and localities to provide vital services such as education, health care, and income support because the after-tax cost of paying state and local taxes will increase for residents who used to itemize."

6. It would create a new voucher-like tax break for private and parochial school tuition.

Under current law, taxpayers can help save for college by putting money into tax-advantaged 529 savings accounts. The House tax bill would, for the first time, allow parents to use 529 accounts for up to $10,000 a year toward private preK-12 school expenses. This would amount to a federal subsidy for private and religious schools. Coupled with Trump’s plan to shift money out of Title I to pay for a federal voucher program, this provision is part of a concerted strategy to shift public funds to private and religious schools.

7. It would hurt higher education students and former students.

8. It would hurt charitable organizations and the people they serve.

Doubling the standard deduction would reduce the percentage of people who itemize deductions from about one-third to about 5 percent. People tend to give more to charities when they know they can deduct those contributions. It is estimated that charitable giving would decline by up to $13 billion a year if the tax bill is approved.

“Republicans have produced a deeply flawed bill that will hurt the teacher who spends his own money to buy school supplies for… students; the young parents who want to know the joy of adopting a child; students trying to responsibly pay back their student loans; the wife trying to afford her husband’s Alzheimer’s care; and the janitor who wants to retire with dignity so he can spoil his grandchildren.”

— Massachusetts Congressman Richard Neal, ranking Democrat on the U.S. House Ways and Means Committee

9. It would widen the wealth gap.

The House plan would first double the estate tax exemption from about $5.5 million to $11 million and then eliminate it altogether. How many educators leave estates of $5.5 million, let alone $11 million? Not many. The wealth gap in the U.S. is already huge. This would make some rich people even richer at a cost to the federal coffers. This loss would have to be made up by taxing low- and middle-income families more and/or cutting services.

10. Gone, gone, gone: Important tax breaks eliminated.

These are just some of the additional tax breaks that would be eliminated by the bill.

"Hypocrisy is at the heart of the tax plan approved today by the U.S. House of Representatives. Their plan takes from working families to pay for massive tax giveaways to corporations and the wealthy."

NEA President Lily Eskelsen García