MTA president told legislators: 'We need to do more than just play defense'

MTA president told legislators: 'We need to do more than just play defense'

The MTA is calling on state budget writers to be prepared to use Fair Share Amendment funds and capture more corporate tax revenue to defend public education from anticipated federal funding cuts and to support financially struggling school districts.

MTA President Max Page testified Monday before the Legislature’s Joint Committee on Ways and Means, which held a public hearing at UMass Amherst on education and local aid spending. Marc Liberatore, co-president of the Massachusetts Society of Professors, which represents faculty members and librarians at the university, joined Page on a panel addressing the committee.

“The dangers public education face now are unprecedented, and we need to do more than just play defense."

MTA President Max Page

The hearing was one of several being held across the state to consider the state’s fiscal year 2026 budget.

Many speakers told the legislative panel that the formula used to calculate state aid to school districts is inadequate, especially when it comes to covering the costs of special education and transportation. Public colleges and universities also are scrambling to mitigate any impacts from cuts in federal funding sources.

Page said the dismantling of the federal Department of Education by the Trump administration will translate into less federal funding for public education at the local level.

“The dangers public education face now are unprecedented, and we need to do more than just play defense,” Page said.

He urged lawmakers to prepare an FY 26 budget that anticipates cuts to vital federal grant programs by planning to use $200 million from Fair Share surplus funds.

As an example of what is happening at public colleges across the state, Liberatore told how a federal grant that supports students studying cybersecurity, and is tethered to future careers in public service, is on hold and seizing up the program.

In addition to tapping into the Fair Share surplus, Page urged the committee to increase the amount of money the state is allowed to collect from global intangible low-taxed income, or GILTI. Massachusetts taxes this multinational corporate income that is moved into tax havens at a rate of 5 percent. Other states tax GILTI at the allowable 50 percent. By getting in line with other states, Massachusetts could generate hundreds of millions of dollars in revenue.

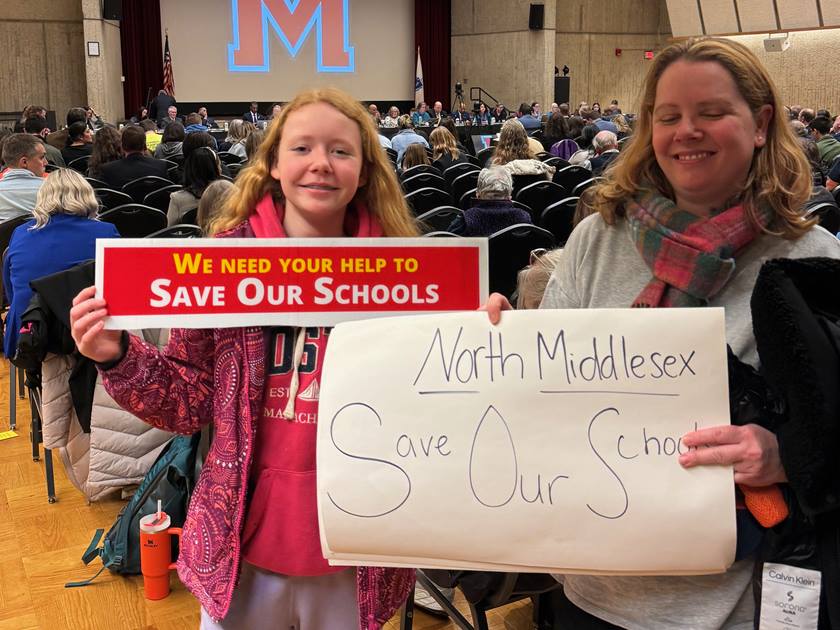

The committee held its hearing as school districts across the state are facing significant budget shortfalls and many have announced staff reductions or attempts to shore up local spending on education through overrides of Proposition 2½.

The MTA is urging the Legislature to improve the special education circuit breaker reimbursements that provide critical funding to local school districts and relief for skyrocketing special education costs. The MTA is also proposing the Whole Child Grant Program with the dual purpose of addressing both the fiscal crisis and the mental health crisis in our schools. The Whole Child Grant Program would provide grant funding to help districts hire more school counselors, Education Support Professionals and other key staff, as well as implement other programs and policies that meet the growing social and emotional needs of our students.

The MTA is part of an alliance, United for Our Future, that is committed to addressing the fiscal crisis facing preK-12 school districts across the state.

Page emphasized the need to ensure students do not lose access to important services and programs in the wake of funding cuts related to changes in how the U.S. Department of Education operates and how other federal agencies function that support public education.

“We all have an obligation to defend public education,” Page said.Read Our Legislative Priorities